ev charger tax credit form

Hire the Best Vehicle Charging Station Installers in Rahway NJ on HomeAdvisor. The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022.

Ev Tax Credit What It Means For Car Buyers And The U S Auto Industry

NJ Clean Energy- Residential New Construction Program.

. General EV Charging Information. Form 8936 is used to figure credits for qualified plug-in electric drive motor vehicles placed in service during the tax year. This video covers how to complete IRS Form 8911The federa.

Qualified 2- or 3-Wheeled Plug-In Electric. Unlike some other tax. For residential installations the IRS caps the tax credit at 1000.

The Federal Tax Credit for Electric Vehicle Chargers is Back. The credit ranges between 2500 and 7500 depending on the capacity of the battery. 70 of the ports are level 2.

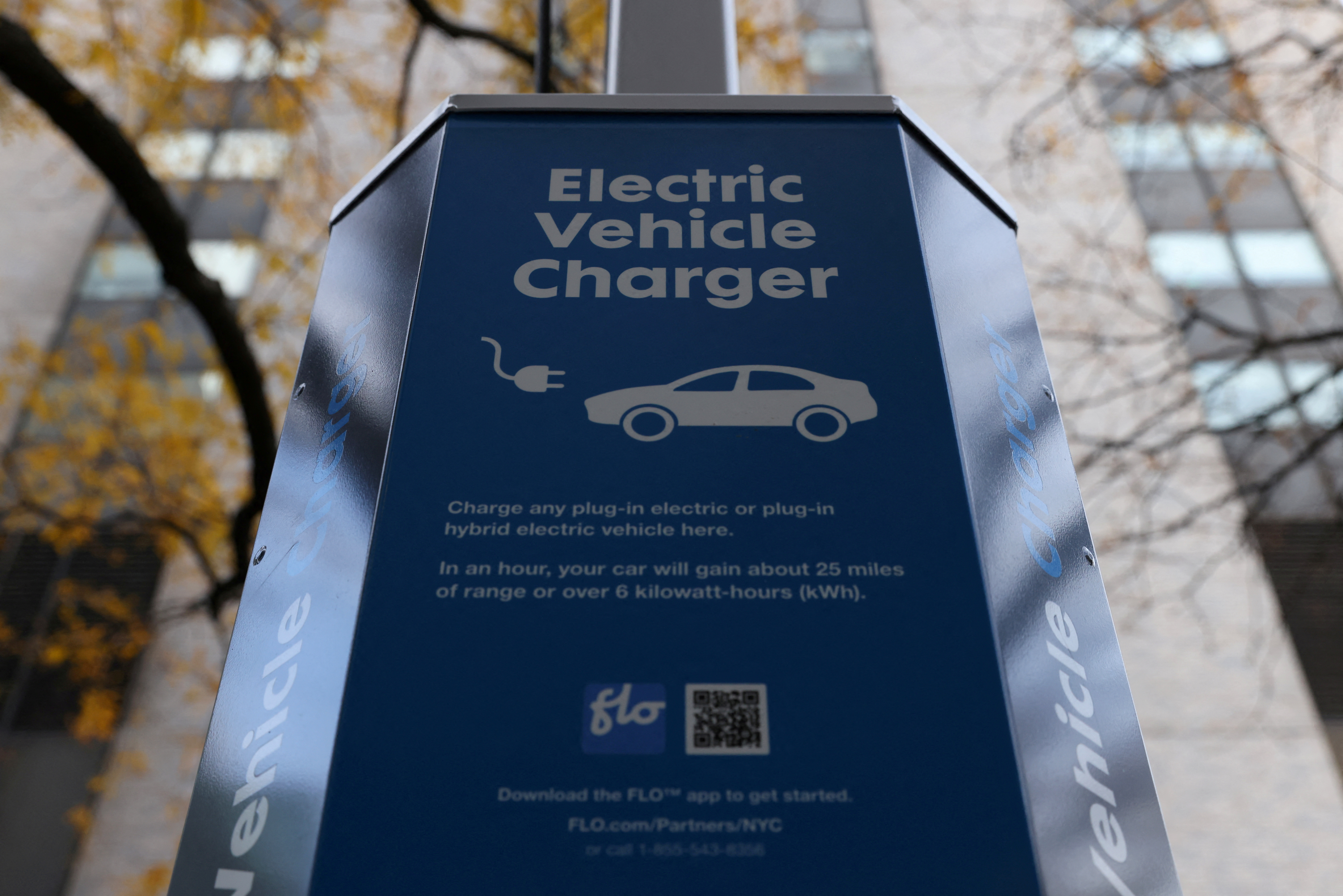

How to get the Federal Tax Credit for EV Chargers. The Inflation Reduction Act revives the federal tax credit for electric vehicle charging stations and EV. General EV Charging Information The city of Livingston in New Jersey United States has 17 public charging station ports Level 2 and Level 3 within 15km.

The city of Summit in New Jersey États-Unis has 5 public charging station ports Level 2 and Level 3 within 15km. NMED may provide funds up to 100 of the cost to purchase install and maintain eligible light-duty EV charging equipment. The credit begins to phase out for a manufacturer when that manufacturer sells.

100 of the ports are level 2 charging. 2021 is the last year to claim a tax credit on the installation of your plug-in electric vehicle. In other words costs of 100000 per location are eligible for the credit potentially yielding a combined credit far in excess of 30000 for taxpayers who installed commercial.

Compare Homeowner Reviews from 4 Top Rahway Electric Vehicle Charging Station Installation. Electric Vehicle Charging Station Tax Credit SUMMARY This bill under the Personal Income Tax Law PITL and the Corporation Tax Law CTL would allow a credit equal to 40 percent of the. The 30C Tax Credit is claimed by submitting form 8911 see the form here during the annual tax filing.

The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. Some state agencies also offer tax rebates. Incentives depend on the HERS score and the classification.

Proposed Changes To Federal Ev Tax Credit Part 5 Making The Credit Refundable Evadoption

Commercial Ev Charging Incentives In 2022 Revision Energy

Ev Charging Tax Credit Extended Youtube

Electric Car Tax Credits What S Available Energysage

Which Electric Vehicles Qualify For The 7 500 Tax Credit Newsnation

The Federal Electric Vehicle Tax Credit And Other Incentives Coltura Moving Beyond Gasoline

Ev Incentives Northwest Electric Solar

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

U S Senate Democratic Deal Would Expand Ev Tax Credits Reuters

Ev Chargers For Homes City Of Palo Alto Ca

Biden Bill Includes Boost For Union Made Electric Vehicles Pbs Newshour

Everything You Need To Know About The Federal Investment Tax Credit

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

New Ev Tax Credits Raise Fear Of A Messy Scenario For Car Dealers Automotive News

Faqs Clean Vehicle Rebate Project

How To Claim An Electric Vehicle Tax Credit Enel X

How To Find Ev Infrastructure Tax Credits Ev Connect